- Your session is secured.

- You will see the default version of our website. The content on our website will not be adapted to your preferences.

- You will see random advertisements.

- Your surfing behavior will not be used to improve our website.

About Argenta

Argenta Bank- en Verzekeringsgroep (Argenta Group) provides retail financial services for families in Belgium and the Netherlands, through Argenta Spaarbank (banking) and Argenta Assuranties (insurance).

Founded in 1956, Argenta is today Belgian’s fifth largest banking institution by customer deposits, with over 1.7 million customers. Its product offering, focused on simplicity and long-term relationships of trust with its family clients, is built on four pillars: savings, lending, insurance and investments. The group operates in Belgium through an extensive network of local self-employed tied agents.

Mission and Vision

Argenta wants to assist families and individuals in living financially healthy lives, in a simple, honest and close-at-hand way.

Argenta wants to achieve this mission with respect for the core values that have marked Argenta’s strategy and corporate culture from the outset:

- Simple, ‘no frills’

- Clean & honest

- Human and close-at-hand

- Enterprising and independent

- Future-oriented and secure

Argenta wants to be a strong and independent bank-insurer with an excellent customer service and lasting relationships with its shareholders, self-employed distribution partners, employees and suppliers.

Argenta wants to be a secure and stable bank-insurer with a sound risk and investment policy focused on sustainability. Secure and stable means, in addition to strong capital and liquidity ratios, that the current rapid digitization goes hand-in-hand with the necessary protection of personal and other data.

In Belgium, Argenta wants to be human and close-at-hand through its self-employed distribution partners but also digitally with a range of retail banking and insurance products tailored to individuals and families.

In the Netherlands, distribution takes place digitally and through independent distribution channels, with a focus on savings and housing loans.

In Luxembourg, Argenta manages investment funds.

Strategy

Towards customers - financially healthy living

Argenta wants to assist individuals and families in living financially healthy lives both today and in the long term. Each customer is entitled to a basic package of services consisting of internet banking and a high degree of self-service. Payment services and securities custody are free. Additionally Argenta offers simple, honest and attractive mortgage lending, savings and insurance solutions that give excellent value for money.

Towards Argenta employees - healthy growth

Argenta wants to be an inspiring environment for its employees. Argenta encourages and supports them in developing their skills and in their personal growth. Each Argenta employee is encouraged to pursue four core competencies: collaboration, customer and result-oriented working, and self-development.

For a healthy and sustainable organization

Argenta wants to implement this strategy through an efficient, lightweight and flexible business organization with a continuous focus on process excellence.

Digitization makes up a substantial part of this business model. Digitally reliable solutions represent at once a challenge and an opportunity to better fulfil our mission. This must not, though, prevent Argenta from remaining accessible, human and close-at-hand.

Sustainability

We want to be sustainable in everything we do. At Argenta, caring is at the heart of the organisation. It connects us and offers individuality. By consciously embedding it, we are aiming for satisfied customers, happy employees and healthy business results in the long term. Taking responsibility is an integral part of our long-term vision.

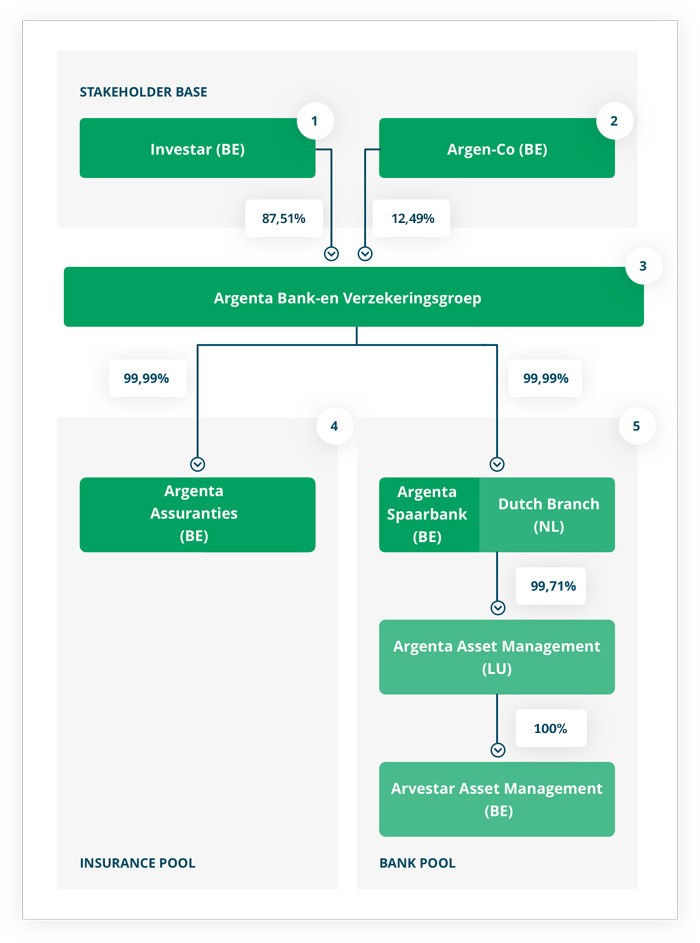

Group structure

1. Investar nv

- A mixed financial holding: core Belgian founding family shareholder with a long term investment view and independent from other financial groups

2. Argen-Co cv

- Issuer of cooperative capital held by around 67,000 cooperative shareholders (employees and clients)

- The by-laws of Argen-Co were amended in 2015 in order to enhance independence from Argenta (i.e. Board of Directors)

3. Argenta Bank- en Verzekeringsgroep nv

- A mixed financial holding: performs group control functions ( Internal Audit, Compliance, Risk Management) and provides group services: Human Resources, Facilities, etc.

5. A bank pool with Argenta Spaarbank nv as the main entity, and

- Dutch Branch Argenta Spaarbank Bijkantoor Nederland

- Luxembourg funds management subsidiary Argenta Asset Management sa whose activity is limited to funds management

- Belgium funds management subsidiary Arvestar Asset Management sa whose activity is limited to funds management

- Argenta Spaarbank is the debt issuing entity of the group

History

1956 - Foundation of Argenta

Argenta was founded by Karel Van Rompuy as a company specializing in offering personal loans. Until today, the Van Rompuy family is still the majority shareholder.

1966 - Argenta Spaarbank

The establishment of Argenta Spaarbank nv enables Argenta to offer saving accounts. This moment also marks the start of the distribution network of independent agents.

1974 - Argenta Assuranties

Argenta Assuranties nv was established, enabling Argenta to offer life and fire insurances. Bankassurance was a fact.

1997 - Argenta Netherlands

Argenta starts selling mortgage loans in the Netherlands.

2010 - Argen-co

Argenta Coöperatieve cv was founded, and launched in 2010 and 2011 a public issue of shares to 67.000 clients and office holders. This gave Argen-co a 15% stake in Argenta.

2016 - Start Wholesale Funding

Argenta starts with wholesale funding and places its first Tier 2 in 2016. Since then RMBS’s (2017), EMTN (2019) and CB (2021) programme are established.

Corporate governance

Executive Committee

Board of Directors

Risk management

Argenta considers risk management as one of its core activities, and recognizes professional, comprehensive risk management as an essential prerequisite for achieving sustainable, profitable growth.

The strategy and long-term policy of all entities within the group are determined by the Executive Committee and Board of Directors of the parent company Argenta Bank- en Verzekeringsgroep nv. The two main subsidiaries, Argenta Spaarbank nv and its sister entity Argenta Assuranties nv, are responsible for operational management within their own areas of competence as established in the Memorandum of Internal Governance.

The Executive Committees of Argenta Spaarbank nv, Argenta Assuranties nv and Argenta Bank en Verzekeringsgroep nv are integrated, with a number of members in common: Chief Executive Officer (CEO), Chief Financial Officer (CFO) and Chief Risk Officer (CRO).

The Board of Directors has installed a structure of committees and subcommittees to address the risks which the group faces. The main committees are

- the Risk Committee of the Board of Directors,

- the Group Risk Committee addressing alternately economic capital, model oversight and operational risk (Orco),

- the ALCO addressing asset & liability management and market risk, and

- the VRC addressing insurance risk.